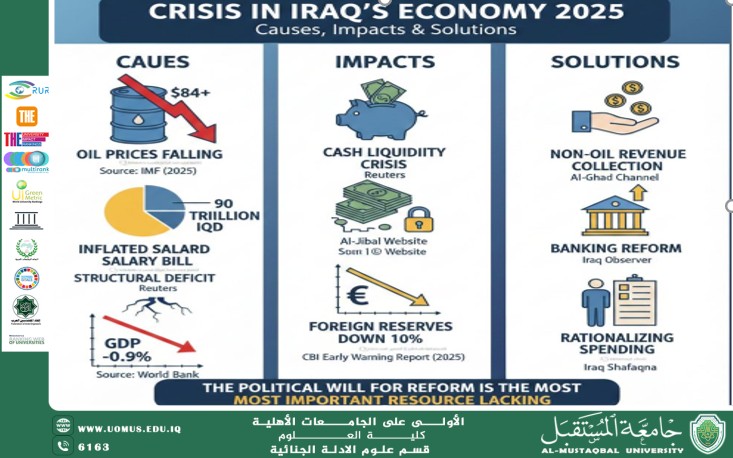

An Economy Built on the “Oil Lung”: Iraq’s Financial Crisis in 2025 — Causes, Implications, and Solutions Asst. Lect. Ali Hassan Mahdi

In 2025, Iraq faces its most severe economic test in years, as the pressures of declining global oil prices intersect with unprecedented growth in operational expenditures. While the government attempts to maintain salary stability, signs of a looming liquidity crisis are emerging—one that could derail development plans and force the country into “no-win” choices.

First: Roots of the Crisis — Why Now?

The current crisis revolves around three main pillars highlighted by international and local reports:

Collapse of Oil Prices:

Iraq relies on oil revenues for nearly 90% of its budget. According to International Monetary Fund reports (2025), the oil price required to balance Iraq’s budget rose from USD 54 in 2020 to approximately USD 84 in 2024–2025. However, current prices fluctuate well below this level due to weak global demand, particularly from China (Source: Al Jazeera Net, September 2024).

Ballooning Wage Bill:

In recent years, hundreds of thousands of new employees have been hired, pushing the cost of salaries and pensions to around 90 trillion Iraqi dinars annually—a figure that consumes the bulk of state revenues (Source: statements by the Prime Minister’s financial advisor to Reuters).

Structural Deficit:

World Bank estimates indicate that Iraq’s GDP could decline by 0.9% in 2025, with a projected budget deficit exceeding 64 trillion dinars if oil prices continue to fall (Source: Tariq Al-Shaab News Agency, October 2025).

Second: Immediate and Expected Impacts

The crisis has not remained confined to the corridors of the Ministry of Finance; its repercussions are increasingly affecting the daily lives of Iraqi citizens:

Cash Liquidity Crisis:

Concerns over liquidity shortages have emerged, reflected in stalled funding for some investment projects and delays in payments to contractors (Source: Al-Jibal Website, December 2024).

Decline in Foreign Reserves:

Reports from the Central Bank of Iraq recorded a 10% drop in net foreign reserves in the first quarter of 2025 compared to the previous year, due to efforts to defend the dinar’s value and cover massive import bills (Source: Central Bank Early Warning Report, 2025).

Widening Poverty Gap:

UN reports have warned that poverty in Iraq has become “structural,” particularly in southern provinces suffering from declining investment and the collapse of basic services (Source: Iraq Shafaqna, November 2025).

Third: Risks of Escalation

Experts warn that continued “explosive spending” without genuine reforms could lead to:

Rapid Depletion of Savings:

Resorting to drawing down cash reserves to compensate for the deficit.

Accumulation of Debt:

Conflicting data on public debt—some sources estimate it has reached around USD 55 billion by mid-2025—undermines the country’s creditworthiness (Source: Central Bank of Iraq, June 2025).

Fourth: Proposed Solutions and a Roadmap

The International Monetary Fund and local experts believe the solution does not lie in waiting for oil prices to rise, but rather in “surgical” measures, including:

Boosting Non-Oil Revenues:

Activating tax and customs collection systems, where losses due to evasion are estimated at around USD 10 billion annually (Source: Al-Ghad Channel).

Banking Sector Reform:

Enhancing financial inclusion and channeling cash hoarded in households into banks to support investment (Source: Iraq Observer, December 2025).

Rationalizing Spending:

Reducing employment inflation and directing support toward the most deserving groups instead of broad, untargeted subsidies that drain the budget.

Conclusion

Iraq possesses the resources and potential to transform into an economic powerhouse. However, 2025 demonstrates that political will for reform is the most critical resource currently lacking—one that is essential to avoiding far darker scenarios.

Al-Mustaqbal University – the first university in Iraq.

SDG4